How to Compare Health Insurance Policy Plans and Find the very best Fit

From comprehending the ins and outs of plan coverage to assessing copyright networks and weighing the costs included, there are important aspects to consider in this decision-making process. As you start this trip in the direction of locating the perfect health and wellness insurance coverage policy, it's essential to come close to the job carefully and with an eager eye for information to make certain that you safeguard the most ideal insurance coverage for your unique scenarios.

Comprehending Policy Protection

When examining wellness insurance plans, comprehending the level of protection provided is vital for making informed choices about your health care needs. Plan coverage details the solutions, treatments, and drugs that the insurance strategy will certainly pay for, along with any limitations or exclusions. It is crucial to meticulously review this info to make certain that the policy lines up with your awaited medical demands.

Coverage information normally consist of inpatient and outpatient treatment, prescription drugs, preventative solutions, mental wellness solutions, and maternity care. Recognizing the specific protection for every of these groups can help you identify if the plan fulfills your specific or family's healthcare requirements - insurance agency near me. Additionally, some policies may offer fringe benefits such as vision and dental protection, alternate treatments, or health cares

To analyze the competence of a plan's protection, take into consideration variables like deductibles, copayments, coinsurance, and yearly out-of-pocket optimums. By thoroughly understanding the policy insurance coverage, you can make an educated choice that makes certain economic defense and accessibility to needed health care services.

Comparing Costs Prices

Understanding the protection information of health insurance coverage plans is essential for making notified decisions concerning your medical care needs, and a critical element to think about when contrasting premium costs is the financial investment required for safeguarding these advantages. A plan with a reduced regular monthly premium might have greater out-of-pocket prices when you require treatment, while a greater costs strategy could offer more extensive protection with reduced out-of-pocket expenditures. Contrasting premium prices along with insurance coverage information will certainly aid you locate a wellness insurance plan that ideal Read More Here fits your needs.

Reviewing Provider Networks

Assessing service provider networks is a vital element of selecting a medical insurance policy that meets your healthcare requires successfully. A service provider network is a list of doctors, hospitals, and various other medical care carriers that have agreements with a specific insurer. When examining company networks, take into consideration the size and scope of the network. A bigger network normally provides more selections and versatility in selecting healthcare service providers. Nevertheless, a smaller sized network could be much more cost-effective if it consists of the companies you choose.

Having medical care suppliers close by can make accessing care extra practical, particularly in emergency situations. Examine if your current healthcare service providers participate in the network to avoid any kind of disturbances in treatment. By completely assessing service provider networks, you can select a health and wellness insurance policy that straightens with your medical care preferences and requirements.

Reviewing Deductibles and Copayments

Examining the financial implications of deductibles and copayments is crucial when choosing a health insurance plan that aligns with your spending plan and health care needs effectively. When examining deductibles, consider both the private insurance deductible-- the amount you pay before your insurance firm covers costs-- and the household deductible, which uses when numerous individuals are covered under the exact same plan.

Copayments, on the various other hand, are set amounts you pay for solutions like medical professional gos Full Report to or prescription medicines. Recognizing the copayment framework for different services can assist you prepare for and prepare for healthcare expenses. Some policies may have coinsurance as opposed to copayments, where you pay a percent of the complete cost of a service. Compare policies to discover the balance in between costs, deductibles, and copayments that finest matches your economic scenario and medical like it care needs.

Examining Additional Benefits

When exploring medical insurance policies, it is vital to carefully check out the extra benefits included past the basic insurance coverage (Losing employer coverage). These additional advantages can vary commonly between insurance coverage plans and can dramatically affect the overall worth and suitability of a plan for an individual's demands

One key added benefit to take into consideration is prescription drug insurance coverage. Some health insurance policy policies use extensive insurance coverage for a vast array of medications, while others might have constraints or require greater copayments for prescription medicines. It is necessary for individuals that depend on prescription drugs to assess this element of a plan carefully.

Other usual additional benefits to examine consist of coverage for precautionary care services, mental wellness solutions, pregnancy treatment, vision treatment, and dental treatment. Depending upon your individual health and wellness demands and preferences, these added advantages could make a considerable distinction in choosing one of the most ideal medical insurance policy.

Final Thought

In final thought, comparing wellness insurance policy policies involves recognizing protection, comparing prices, reviewing copyright networks, reviewing deductibles and copayments, and checking out fringe benefits. By meticulously examining these elements, people can discover the very best suitable for their healthcare requires. It is essential to consider all elements of a policy prior to deciding to make certain detailed coverage and affordable expenses.

Michael Jordan Then & Now!

Michael Jordan Then & Now! Sydney Simpson Then & Now!

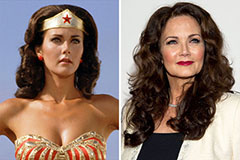

Sydney Simpson Then & Now! Lynda Carter Then & Now!

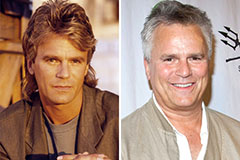

Lynda Carter Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now! Nicki Minaj Then & Now!

Nicki Minaj Then & Now!